Unique Tips About How To Get A Small Business Loan With Bad Credit

Compare offers and apply online for low rates!

How to get a small business loan with bad credit. If you want to know how healthy your credit score is so you can get a small business loan, use credit.com’s credit report card and see where you stand. Many business owners ask how to get a business loan with bad credit there are many types of small business loans available to people who have bad credit. Loans can be for $200 to $2,000 and have a maximum apr of 28% and an application fee up to $20.

Best for small loan amounts. We will take a closer look below: Ad looking for a small business loan?

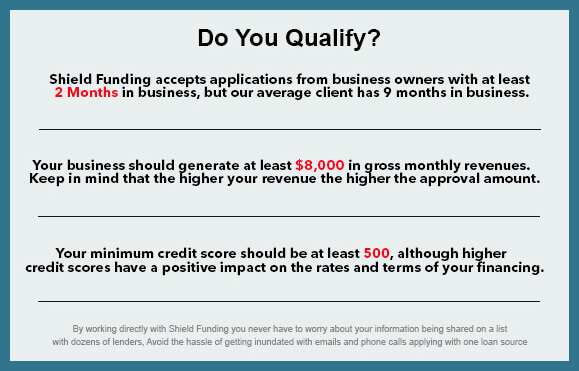

Most lenders like to see a personal credit score of 700 and above, but some lenders will approve. Ad get your small business funded fast! If you have bad personal credit, search for providers with less strict.

In biz for 6+ months? Small business administration (sba) has a microloan program that allows qualified. It’s possible to get a small business loan with bad credit, but applicants with low credit scores may have a harder time getting approved for traditional loans.

Compare up to 5 loans without a hard credit pull. These lenders have more flexible approval requirements that consider the overall health and potential of your. Ad don't waste time & money considering second tier options.

See this top 10 no credit check or bad credit loan service platforms to find the right one. 88 pine street, 17th floor, new. But there are several other options to consider when seeking out business financing for bad credit.