Awe-Inspiring Examples Of Tips About How To Buy Tips Inflation

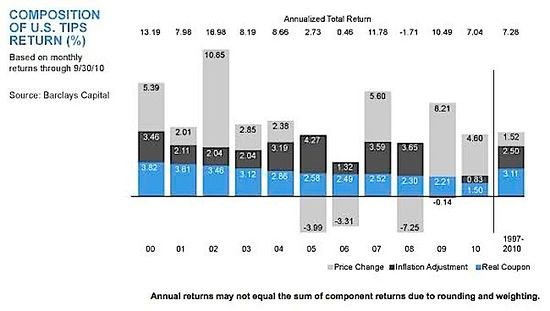

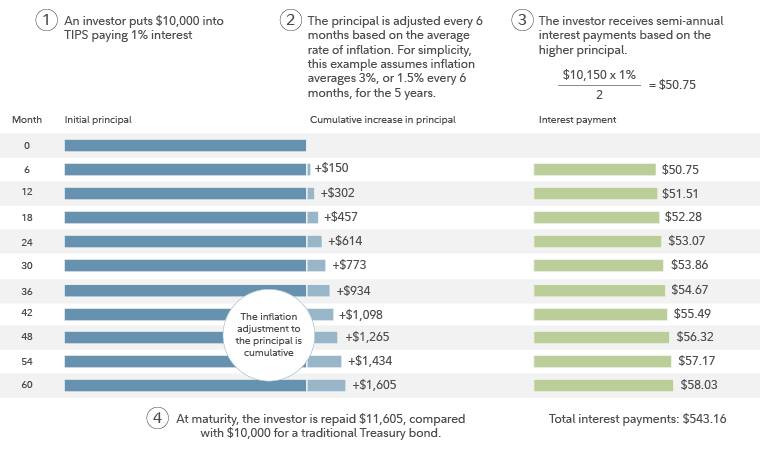

Treasury provides tips inflation index ratios to allow you to easily calculate the change to principal resulting from changes in the consumer price index.

How to buy tips inflation. Treasury bonds designed to keep up with the rate of inflation. Follow the link and locate the index ratio that corresponds to the interest payment date for your security. Turn the air conditioning off;

Treasury or through a bank, broker, or dealer. To save money on gas, you can: This is a cumulative adjustment too, so the principal balance can.

Treasury bond designed to help investors protect against inflation. You can buy tips through your online brokerage account or directly from the u.s. Treasury security whose principal value is indexed to the rate of inflation.

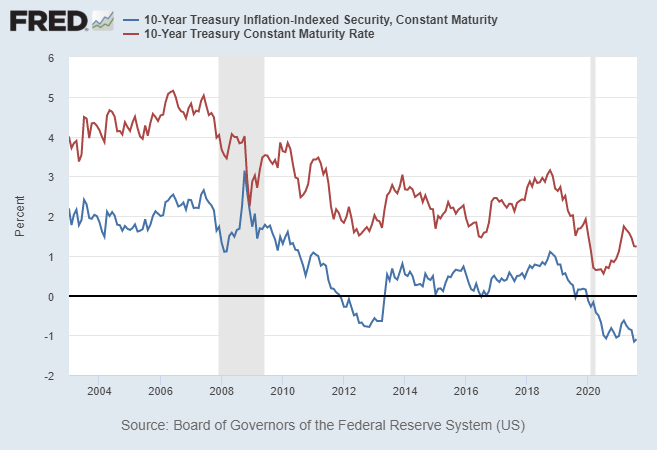

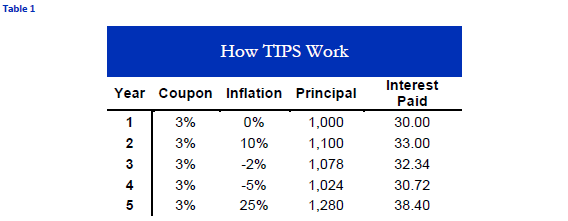

While tips will work as intended for investors who buy individual bonds and hold them to maturity, those who hold tips via mutual funds or etfs face an entirely different set of. Improve your credit score and financial picture. Tips pay interest twice a year, at a fixed rate.

Tips are issued for terms of 5 years, 7 years, and 30 years. When inflation rises, tips’ value and coupon payments rise, as well. The minimum purchase is $100.

So, like the principal, interest payments rise with inflation and fall with deflation. Tips are issued in electronic form. For instance, switching internet or cable providers could get you six months or even a year of.

:max_bytes(150000):strip_icc()/ConsumerPriceIndexMay2021-March2022-dc1092620e5740b08d4cb5bff8fc47bd.png)