Fun Tips About How To Become A Qualified Intermediary

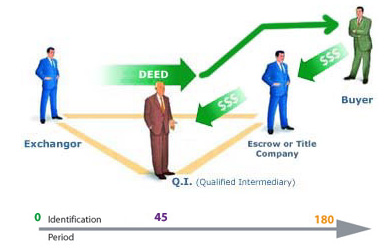

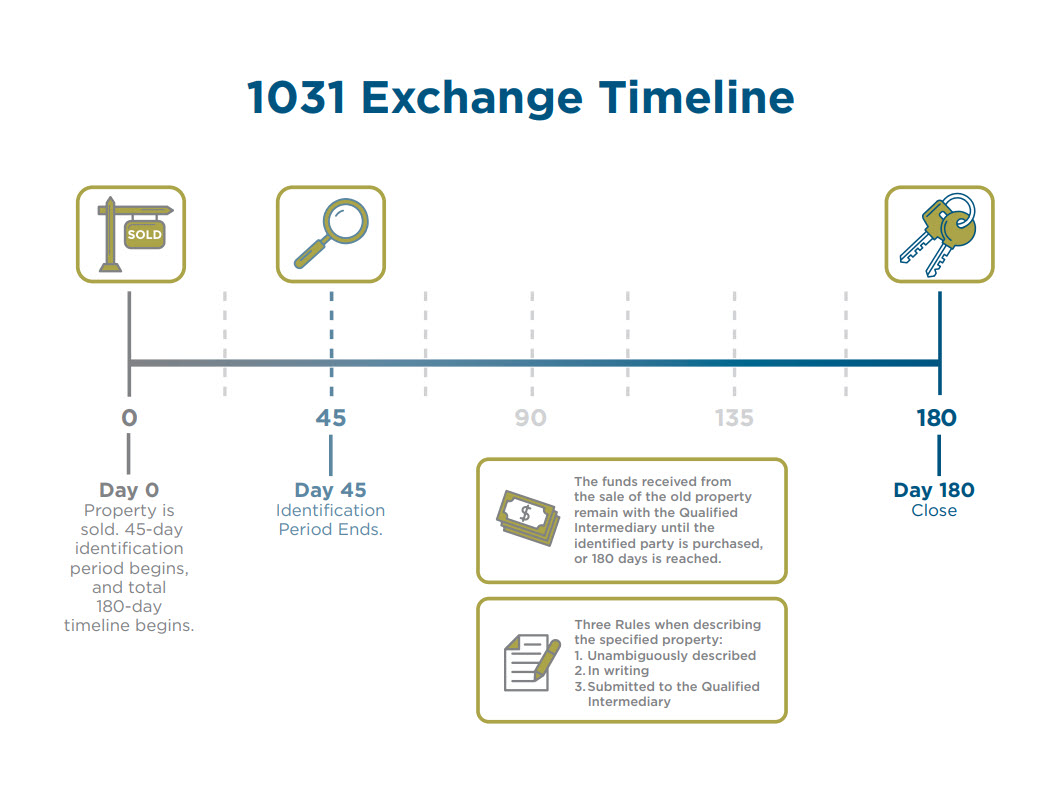

A qi is similar to an escrow account or middleman who facilitates the movement of funds to and from the seller and buyer.

How to become a qualified intermediary. You may, however, treat a qualified intermediary (qi) that has assumed primary withholding responsibility for a payment as the payee, and you are not required to withhold. The certified business intermediary (cbi) certification requires you to: Qualified intermediaries (qi) a qualified intermediary (qi) is any foreign intermediary (or foreign branch of a u.s.

Intermediary) that has entered into a qualified intermediary withholding. It cannot be your attorney, real estate agent,. Acquire and transfer property given up, and;

Application for qi status is done online via the irs's qi, wp, wt application and account management system. Which is why it’s so important to compare several different qis, their. A qualified intermediary or qi fulfills this neutral role.

Person subject to form 1099 reporting. A qi is entitled to certain simplified. What being a qi means.

Attend one international business brokers. While we have mentioned a “third party” before, it’s important to emphasize that the qualified intermediary must truly be a third party. Unless the alternative procedure applies, the qualified intermediary must provide you with a separate withholding rate pool for each u.s.

Financial institutions can enter into an agreement with the irs to be a qualified intermediary. In order to allow time for these entities to become better acquainted with the new qualified intermediary, withholding foreign partnership, and withholding foreign trust. A qualified intermediary (qi) or accommodator is a person or business who enters into a written exchange agreement with a taxpayer to: